But the path between research discoveries and their potential applications can be long, winding, and complex. If you plan to commercialize them (startup, new product launch, etc.), you will need to quickly identify the need actually met by the innovation, the associated market, the competition (most often "the competition"), and the first customers.

Discover how to bring your innovations to the right market while limiting your risks.

Creating a start-up when you're a researcher: a demanding but exciting path

Creating a start-up when you're a researcher: a demanding but exciting path

What problem does your innovation solve? What will it allow you to do that other technologies cannot? What does it do better than other approaches?

Will it bring a cost advantage, feasibility, or a new service?

Who will be your first customers? Is it a promising market? What business model will be best suited for them and for you?

How will you convince investors of your project's potential?

Do you have serious barriers to entry for future competitors, such as a strong portfolio of patents with proven value?

For a researcher, embarking on the creation of a start-up is both an exciting adventure but will also involve a lot of questioning.

What could be more satisfying than seeing, with a few years' hindsight, the positive impact on society of long and uncertain research? But how can you also identify unmet market needs, pivot, change target, or even give up when the market isn't ready, or when the drawbacks of your technology turn out to be greater than initially imagined?

These are just some of the questions, dilemmas, and uncertainties you will face.

However, simply arriving with a revolutionary innovation is not enough to guarantee a warm welcome from the market . Even the best science in the world, if it fails to address a critical need or significantly improve existing processes and technologies, will not succeed in breaking through the innovation barrier.

RESEARCHER-ENTREPRENEUR: HOW TO IDENTIFY THE RIGHT MARKET?

RESEARCHER-ENTREPRENEUR: HOW TO IDENTIFY THE RIGHT MARKET?

The first question you need to answer is: "What problem are you actually going to solve for your future customers? "

Answering this question will allow you to define your value proposition, clearly list all forms of competition (and your competitors), and gain a clear vision of the market segments to prioritize. Indeed, there's a good chance your innovation will address several problems in very different markets. Furthermore, there's a very good chance you'll have very limited visibility on these markets initially.

Coming from an academic background, you clearly already have a clear vision of a few very specific application areas; these are often linked to your collaborations with industry, which is invaluable. However, other markets, other segments that are far less obvious or even completely unknown to you, may ultimately prove to be much more relevant for ensuring the success of your startup. Pivots are costly… sometimes essential but costly… and sometimes triggered too late.

The importance of taking a step back when conducting market research and broadening one's research area.

To avoid choosing the wrong market to investigate, you'll need to conduct a 360° analysis as the first step in your market research. In practice, we often do the exact opposite: we dive into two or three market segments, and if we fail, we move back up. This exercise is intellectually demanding and difficult to implement, especially when time is of the essence—and for a startup or SME, that time is called cash flow!

Let's take the example of a researcher who developed an ultrasound generator capable of characterizing liquid solutions in real time . Having completed his thesis in the hospital setting, the first obvious area of application for creating his start-up was to develop a medical device designed to monitor the patient's condition during open-heart surgery.

Niche market, very long time to market.

The need being met was clearly critical and the proposed solution interesting. But it also seemed obvious that setting up the startup by immediately targeting this initial market would prove complex (regulations, fundraising, certifications, etc.).

In other words, years of work and development, and hundreds of millions of euros in investment, would be required before the startup generated a single euro in revenue . The immediate question for the researcher and the incubator was: was there a more accessible and promising market? Two other markets were instinctively mentioned: chemicals and food processing. Without delay, a market study was launched in these sectors, but unfortunately, the results were inconclusive: the technology in question did not solve any critical problems, or problems identified as such by the industry professionals interviewed.

Back to square one!

Only after conducting a rapid 360° analysis based on technical and scientific literature were new and very surprising functionalities and areas of application identified . These then made it possible to investigate significantly different markets, such as the building and public works sector, and to quickly identify market segments with very rapid access and offering significant potential.

This example illustrates the need for researchers to have a 360° view of all markets that might be interested in their technology.

It's also quite real: the startup in question enlisted the services of TKM, which, after analyzing all the global scientific literature, advised it to develop its business in the construction industry on a very specific and critical application (that is, one with associated economic stakes estimated in the millions of euros).

Since then, this startup has worked exclusively with cement manufacturers and construction companies, offering them in-situ monitoring solutions for the hardening of concrete structures.

Without TKM's intervention, it would have taken months and a series of fortunate coincidences for this researcher to even consider approaching a cement manufacturer. With TKM, he only needed 5 days of research to identify a market – and therefore clients! – that he would never have imagined .

TKM: REDUCE YOUR TIME-TO-MARKET BY TARGETTING THE RIGHT MARKETS FROM THE START

TKM: REDUCE YOUR TIME-TO-MARKET BY TARGETTING THE RIGHT MARKETS FROM THE START

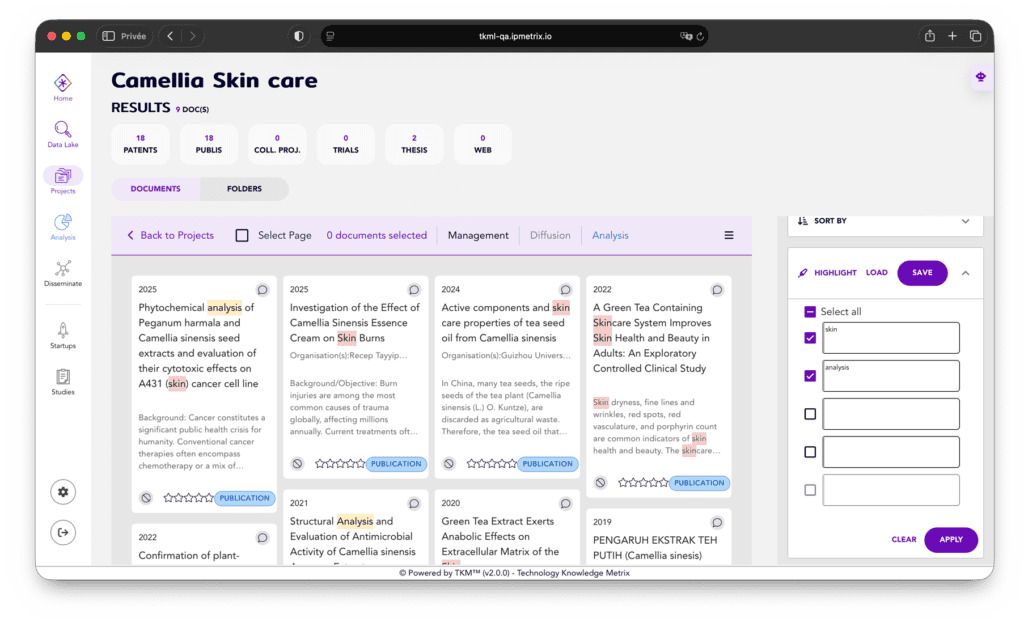

Specializing in state-of-the-art, scientific monitoring, technological monitoring and intellectual property strategies, TKM has developed a software platform.

By using TKM, you'll also gain a much more detailed view of your competition, not just your direct competitors. Because the same problem can be addressed with numerous technologies… and you can't afford to ignore an indirect competitor.

Discover TKM Platform

- "Data Lake" module :

Search, collect and export - “Projects”

Module : Organize and manage your projects - Analysis

module : Analyze and interpret your data - “Watches”

module : Edit and share your watchlists - “Start-up”

module : innovative start-ups and SMEs - “Studies”

module : Find here the deliverables prepared for you by TKM Services

So!

Are you ready to find the most relevant market for your research?

Creating a start-up when you're a researcher: a demanding but exciting path

Creating a start-up when you're a researcher: a demanding but exciting path

RESEARCHER-ENTREPRENEUR: HOW TO IDENTIFY THE RIGHT MARKET?

RESEARCHER-ENTREPRENEUR: HOW TO IDENTIFY THE RIGHT MARKET?

TKM: REDUCE YOUR TIME-TO-MARKET BY TARGETTING THE RIGHT MARKETS FROM THE START

TKM: REDUCE YOUR TIME-TO-MARKET BY TARGETTING THE RIGHT MARKETS FROM THE START